How Positioning and Consolidation Has Impacted the SSD Market

There can be only one! Ok, so the SSD market certainly will not consolidate to one company, but we are seeing a lot of movement. One company acquiring the next in order to gain all of their wisdom and power. Hopefully, not using the same methods as Connor MacLeod did in the Highlander films. This is not the first time consolidation has happened in the storage device market. We’ve seen similar consolidation through the years in the HDD market. In 1994 the HDD market had 10 manufacturers; by 2012 they were down to 3 major players. At the beginning of these 18 years of positioning and consolidation, there was plenty of market share to go around and acquiring a business with even 10% of the market share is no small feat.

Graphic Source: Chris Ritter, Buzzfeed.com

When looking at the SSD market today, there are several larger players and still many smaller players, and even some still entering the market, each trying to position themselves for growth and increased market share. There is a good reasoning to why. SSD’s in comparison to HDD’s are still in their infancy. There are also such a variety of newer devices and market segments evolving such as the cloud, mobile devices, traditional enterprise data center storage and desktop/laptops (much of which is SSD or flash based storage). Mature companies as well as startups are identifying user’s diverse needs and wants and adding their own niche’ or innovation to SSD based products and releasing them to the market. With so many in the SSD market today, what does the market share look like?

On June 10th, Gartner released the “Market Share Analysis: SSDs and Solid State Arrays, Worldwide 2013.” The chart below taken from this report outlines the movement in the SSD market from 2012 to 2013. The top 3 in the market in 2013, Samsung, Intel and SanDisk share just under 53% of the market share. From there the market share drops dramatically ending with an “Others” category which only makes up 10% of the market share. I think it is safe to assume that if a company with a smaller piece of the pie has a unique, innovative solution for SSD’s, it is eventually going to get acquired by one of the top companies.

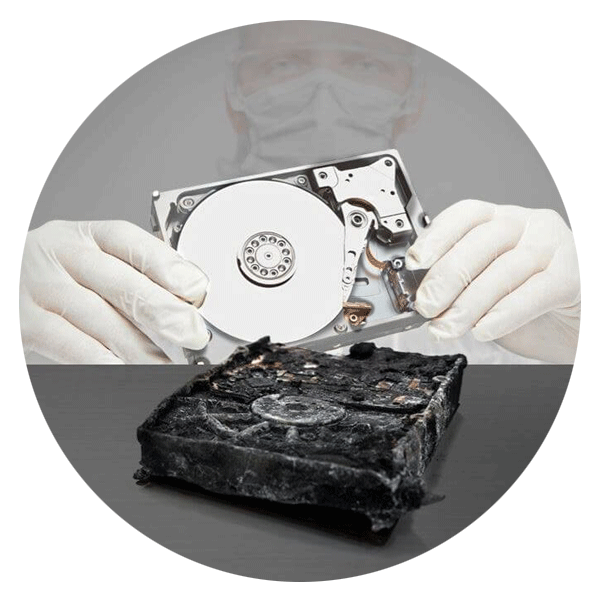

Total SSD Market

SanDisk recently did just that when they acquired Fusion-io for $1.1 Billion. SanDisk who has been working to sell into companies worldwide will use Fusion-io’s PCIe solutions to create enterprise-class SSDs for data centers. Overall, this absorption of technical advancement should create a superior product for SanDisk and continue their penetration into data centers. I know we often have fond memories of certain companies and may be a little saddened to see them acquired by a larger entity, but in the end those acquisitions may benefit us. All of the articles that I have read on the SanDisk/Fusion-io acquisition all talk about why this is good for the two companies involved. Let’s take a look on what these types of acquisitions can do for the consumer. Hopefully, when one company acquires another it is not just for the sake of eliminating the weak. Most often in the tech industry there is a certain technical benefit to those acquisitions. In SanDisk’s case, it is the PCIe solution. Those technical benefits combined with the larger companies established product, and sales channel, should evolve into a superior product for the consumer. In the SSD market, as we see smaller companies absorbed by the larger ones, better SSDs should enter the market. In most cases, it is easier and faster for companies to merge an existing technology with their own than to develop it from scratch, so these new solutions should be quick to market. From a data recovery perspective, these acquisitions should result in more capabilities and less time required to recover mission critical data from a dysfunctional SSD. As companies and technologies consolidate, there will be more standards and similarities created in how underlying data is written to an SSD. Instead of dozens or hundreds of unique proprietary methods companies are using to write data to SSDs, such as different methods of implementing wear leveling, data scrambling, encryption, ECC, and the likes, as companies consolidate, so will the various technologies used, similarly to what has occurred in the HDD industry. This equates to less research time our engineering teams will need to discover the writing method and the faster return of the data to you, resulting in less cost to the end users. How long will it take for the SSD market to consolidate and stabilize? I don’t have the answer to that, but would like to hear your guess in our comments section.

P.S. For those of you who need a little reminder on Highlander, here’s a flashback for you

.

Call for Immediate Assistance!

- Crypto Currency (2)

- Data Backup (9)

- Data Erasure (8)

- Data Loss (15)

- Data Protection (11)

- Data Recovery (22)

- Data Recovery Software (2)

- Data Security (3)

- Data Storage (15)

- Degaussing (1)

- Deleted Data (5)

- Digital Photo (2)

- Disaster Recovery (6)

- Encryption (1)

- Expert Articles (5)

- Hard Drive (7)

- Laptop/Desktop (7)

- Memory Card (5)

- Mobile Device (13)

- Ontrack PowerControls (1)

- Raid (5)

- Ransomware & Cyber Incident Response (6)

- Server (6)

- SSD (14)

- Tape (17)

- Virtual Environment (9)